Quick Answer: What is an Order Block in Smart Money Concepts?

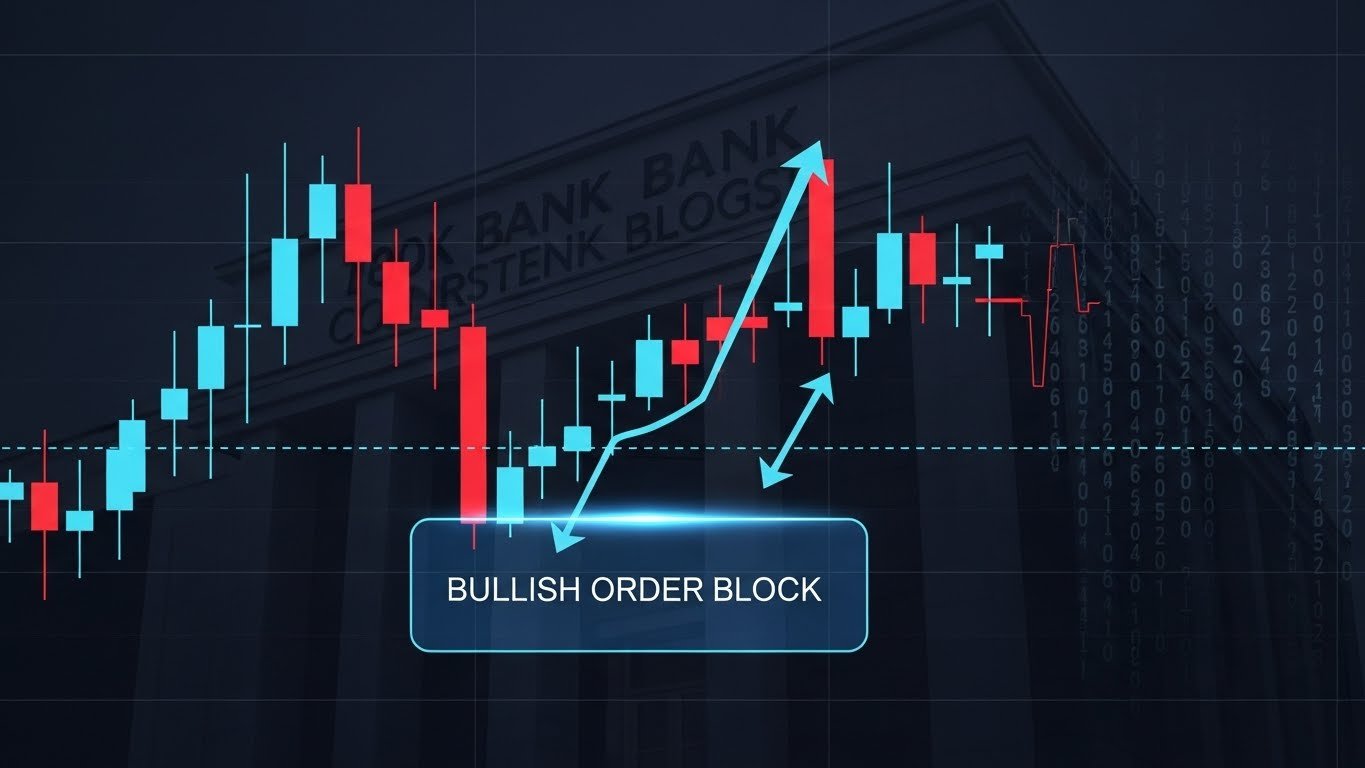

An Order Block (OB) is a price zone on the chart where financial institutions (Smart Money) have placed large orders. Practically, it is the last opposite-colour candle before a strong impulsive move that breaks market structure. In 2026, Order Blocks combined with Liquidity Grabs and Fair Value Gaps (FVGs) form one of the most powerful rule-based institutional trading frameworks available to retail traders.

You can spend years drawing trendlines, channels, and chart patterns and still feel like the market is always one step ahead of you.

Price taps your Stop Loss by a few points, then flies straight in your original direction. It feels personal. It feels unfair.

The truth is simple: the market is not random. It is engineered around liquidity.

Smart Money Concepts (SMC) is a way of reading that engineering. Instead of reacting to indicators, you start reading:

- Where liquidity sits (Retail Stop Loss clusters).

- Where banks accumulate positions (Order Blocks).

- Where price is likely to rebalance (Fair Value Gaps and Imbalances).

The SMC Masterclass Curriculum (2026 Edition)

- 1. Retail vs Smart Money: The Mindset Shift

- 2. Order Blocks: Definitions, Types & Quality Rules

- 3. Fair Value Gaps (FVG): The Institutional Price Magnet

- 4. Liquidity & Stop Hunts: How Banks Find Their Entries

- 5. Market Structure Shift (MSS) & Break of Structure (BOS)

- 6. The Complete SMC Strategy: A-to-Z Process

- 7. Risk Management & Timeframe Framework

- 8. Grand Slam Offer: Trade SMC Live With Us

- 9. Frequently Asked Questions (SMC & Order Blocks)

Educational & Risk Disclaimer

This guide is for educational purposes only. Smart Money Concepts do not remove risk. Trading forex, indices, crypto, stocks or derivatives carries a high level of risk and may not be suitable for all traders. Always test concepts on demo and consult your financial advisor before risking real capital.

1. Retail vs Smart Money: The Mindset Shift

Most retail education is built around simple patterns:

- Horizontal support and resistance.

- Double tops and double bottoms.

- Head and shoulders patterns.

- Trendline bounces and breakouts.

There is nothing “wrong” with these tools. The problem is how they are used.

Retail logic: “Price rejected three times from resistance. If it breaks above, I buy the breakout with my Stop Loss below.”

Smart Money logic: “Above that resistance is a huge pool of Buy Stops and breakout Buyers. That is where we will Sell into them.”

Once you accept this, your focus shifts from “predicting the future candle” to answering three questions:

- Where are traders trapped?

- Where are their Stop Losses clustered?

- Where can big players execute large orders without moving price too far?

2. Order Blocks: Definitions, Types & Quality Rules

Bearish Order Block: The last bullish candle (up candle) before a strong bearish impulse that breaks a previous low or market structure.

Not every opposite candle is an Order Block. A valid OB must have:

- Displacement: A strong, clean move away with large full-bodied candles.

- Break of Structure: It must break a previous swing high/low (BOS), not just create a random spike.

- Imbalance: Often leaves a Fair Value Gap (FVG) behind.

- Liquidity Grab: Ideally, it sweeps previous equal highs/lows before moving.

Types of Order Blocks (Practical View)

| Type | Location | Strength | Notes |

|---|---|---|---|

| Reversal OB | At extreme highs/lows of a range | Very High | Often forms after a liquidity sweep and major BOS. |

| Continuation OB | Within a trend (pullback area) | High | Used for “trend following” entries after retracements. |

| Mitigated OB | Previously tapped OB | Lower | Avoid if price has already respected it multiple times. |

We prefer fresh, unmitigated Order Blocks that:

- Caused a clear BOS.

- Left behind an FVG.

- Took liquidity (ran stops) before moving away.

3. Fair Value Gaps (FVG): The Institutional Price Magnet

When institutions aggressively move price, the market can skip levels. This creates an Imbalance between buyers and sellers.

Why FVGs matter:

- Price is attracted back to FVGs like a magnet.

- They provide excellent entry or target zones.

- When an FVG overlaps an Order Block, the zone becomes extremely powerful.

4. Liquidity & Stop Hunts: How Banks Find Their Entries

Smart Money cannot enter with 1–2 lots; they enter with thousands. To avoid slippage, they need the market to provide opposite orders at good prices.

Where Does Liquidity Come From?

- Retail Stop Losses placed below obvious lows and above obvious highs.

- Breakout traders entering after the move already started.

- Equal highs/lows where many traders place stops at the same level.

SMC traders do not chase the breakout. We wait for the “stop hunt” – the liquidity sweep – and then trade in the opposite direction from the institutional zone.

5. Market Structure Shift (MSS) & Break of Structure (BOS)

Order Blocks and FVGs tell you where you want to trade. Market Structure tells you when to trade.

Break of Structure (BOS)

- In an uptrend, a BOS occurs when price breaks above a previous swing high.

- In a downtrend, a BOS occurs when price breaks below a previous swing low.

Market Structure Shift (MSS) / Change of Character (ChoCh)

MSS signals that the trend is likely changing:

- In a downtrend, when price takes out a previous lower high strongly, we see a potential bullish shift.

- In an uptrend, when price takes out a previous higher low strongly, we see a potential bearish shift.

| HTF Context | Entry Timeframe | Trigger | Example Flow |

|---|---|---|---|

| Daily Bullish Bias | 15m / 5m | Bullish MSS at OB | Daily Bullish OB → Liquidity Sweep → 15m MSS → 5m OB entry. |

| H4 Bearish Bias | 5m / 1m | Bearish MSS at OB | H4 Bearish OB → Equal Highs swept → 5m MSS → 1m OB entry. |

6. The Complete SMC Strategy: A-to-Z Process

Step 1: Choose Your Higher Timeframe Bias

- Use Daily + H4 for swing trading.

- Use H4 + H1 for intraday trading.

Mark:

- Major swing highs and lows (liquidity zones).

- Valid Order Blocks that caused BOS.

- FVGs aligned with your directional bias.

Step 2: Identify Your Point of Interest (POI)

A strong POI usually has:

- A clean Order Block.

- A liquidity sweep just before the displacement.

- An overlapping FVG or nearby imbalance.

Step 3: Wait for Price to Tap the POI

Set alerts and let price come to you. We do not chase. When price arrives at the POI:

- Drop to a lower timeframe (15m/5m/1m depending on your HTF).

- Watch for a Market Structure Shift (MSS) in your intended direction.

Step 4: The Precision Entry

After MSS on the lower timeframe:

- Mark the LTF Order Block that caused the MSS.

- Place a limit order at the OB or its 50% level (refined entry).

- Stop Loss: Just beyond the OB or below/above the liquidity low/high.

- Take Profit: Next HTF liquidity pool (old high/low, session high/low, etc.).

Step 5: Management & Scaling

- Consider partial profits at 1R–2R and move SL to breakeven.

- Trail behind new swing points if the trade becomes a runner.

- Journal screenshots and notes: POI, liquidity taken, MSS, OB quality.

Common SMC Mistakes to Avoid

- Taking every OB you see without BOS or liquidity context.

- Trading against higher timeframe direction purely on a small OB.

- Using huge lot sizes because OB entries give tight stops.

- Changing rules daily instead of backtesting one set of rules deeply.

7. Risk Management & Timeframe Framework

Smart Money Concepts give you better entries, not immunity from losses. You still need a professional risk framework.

Timeframe Map

| Trading Style | Bias Timeframes | POI Timeframes | Entry Timeframes |

|---|---|---|---|

| Swing Trading | Weekly + Daily | Daily / H4 | H1 / M15 |

| Intraday | Daily + H4 | H1 / M15 | M5 / M1 |

| Scalping | H4 + H1 | M15 / M5 | M1 |

Risk Rules for SMC Traders

- Risk 0.5%–1% of account per trade, maximum.

- Daily max loss: 3%. Weekly max loss: 6–8%.

- Stop trading for the day after hitting daily max loss.

- Avoid trading purely based on feeling “left out” of a move. No FOMO entries.

SMC Success Principle

SMC is not about finding zero-loss entries. It is about stacking confluences (OB + Liquidity + FVG + MSS) and then executing with small, controlled risk and consistent rules.

“Stop Guessing Candles. Start Reading Institutions.”

You can spend months trying to decode Smart Money Concepts alone, or you can sit inside a live environment where SMC traders mark Order Blocks, FVGs and liquidity zones in real-time and explain every decision.

Join the Trade Like Master – Institutional Mentorship

- Live SMC Trading Sessions on indices, forex, gold and crypto.

- Proprietary SMC Toolkit: auto-drawing OBs, FVGs and MSS (lifetime access).

- Structured video course: from basics to advanced institutional models.

*Seats are limited to ensure live support and chart review quality.

9. Frequently Asked Questions (SMC & Order Blocks)

Does Smart Money Concepts work on Nifty, BankNifty and Indian stocks?

Yes. SMC is a way of reading liquidity and institutional behaviour. Any liquid market influenced by larger players – including Nifty, BankNifty, major Indian stocks and global indices – can be analysed using SMC principles such as Order Blocks, FVGs and liquidity sweeps.

Which timeframe is best for learning and applying SMC as a beginner?

For learning, start with H4 and H1 because structure and Order Blocks are cleaner and less noisy. Once you understand concepts clearly, you can move to M15/M5 for intraday entries while still respecting higher timeframe bias.

Is SMC better than classic price action or indicators?

SMC can be seen as advanced price action. Instead of focusing only on lines and patterns, it focuses on who is trapped, where liquidity sits, and how institutions move price to those zones. Many traders find SMC more logical and rule-based compared to indicator-only systems, but it still requires practice and discipline.

How long does it take to become consistent with Smart Money Concepts?

It varies by person. Some traders start seeing structure clearly in a few weeks, while consistency may take several months of backtesting, journaling and live practice with small risk. SMC is a professional framework, not a quick hack, so plan for a serious learning curve instead of expecting instant results.

Can SMC strategies be automated into bots or EAs?

Certain parts of SMC can be automated, such as detecting Order Blocks, FVGs, BOS and MSS conditions. However, full automation is challenging because SMC also involves contextual judgment (session timing, higher timeframe narrative, news environment). Many traders use semi-automation: indicators to mark zones and alerts, with manual decision-making for entries.

Is SMC suitable for small accounts?

Yes, provided you manage risk carefully. SMC often uses tight Stop Losses, which can be beneficial for small accounts if you size positions correctly and keep risk per trade low. The main danger for small accounts is emotional over-leverage, not the SMC method itself.

Can Smart Money Concepts guarantee a high win rate?

No approach can guarantee a specific win rate. SMC provides high-quality locations and confluences, but results depend on execution, psychology, risk control and market conditions. Many traders focus more on achieving a good Risk-to-Reward ratio with SMC (for example, 1:3 or better) rather than chasing a perfect win rate.

Do I need expensive data or institutional tools to trade SMC?

No. Most SMC concepts can be applied with normal candlestick charts on platforms like TradingView or MetaTrader. Enhanced tools (like depth-of-market, footprint charts or premium data feeds) can help advanced traders, but they are not mandatory for learning the core SMC framework of Order Blocks, FVGs, liquidity sweeps and MSS.

Written by Trade Like Master

Trade Like Master specialises in institutional-style trading education, Smart Money Concepts and algorithmic execution. Our mission is to help serious traders move beyond retail patterns and understand how liquidity, order flow and market structure actually drive price.